Alibaba Boss Warns AI Boom Might Be Heading For A Bubble!

For years, experts have been warning about the possibility of an AI bubble bursting. Yet, despite these warnings, companies continue to pour massive amounts of money into Alibaba artificial intelligence (AI) infrastructure. But is this frenzy of investment sustainable, or are we witnessing a potential financial disaster in the making?

The Unstoppable AI Investment Machine

AI has become one of the most talked-about and heavily funded sectors in recent years. Companies around the world are building massive data centers to support the ever-growing demands of AI models. Whether this investment will continue to pay off or lead to a huge financial collapse is still uncertain. What’s clear, however, is that even some of the most experienced tech executives are starting to worry.

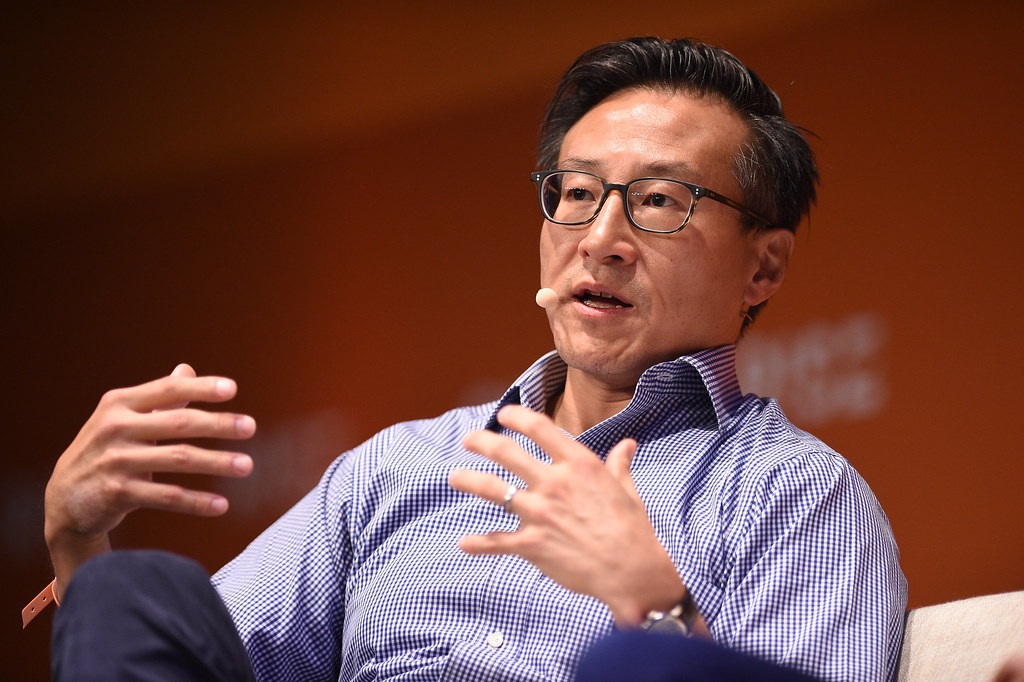

Joe Tsai, the chairman of Alibaba, has raised alarms about the sheer scale of investment in AI, particularly in the construction of data centers. Alibaba itself has committed to investing over $52 billion in AI development over the next three years. But Tsai isn’t sure all this spending is justified. In fact, he’s sounding the warning bell about a potential bubble.

The AI Bubble: A Growing Concern

During a recent event in Hong Kong, Tsai openly discussed his concerns. Alibaba pointed out that many of the new AI data centers being built are being constructed without clear customers lined up. In other words, companies are investing heavily without knowing if there will be enough demand to justify these colossal projects.

“I start to see the beginning of some kind of bubble,” Tsai said, according to a Bloomberg report. His words caught attention, and Alibaba’s stock dipped nearly 4% in response.

The Shockwave of Chinese Startup DeepSeek

One of the most significant signs of trouble for the AI sector came from an Alibaba unexpected source—a Chinese startup named DeepSeek. This company managed to develop a highly advanced AI at a fraction of the cost of its Western counterparts, leaving Silicon Valley in shock. DeepSeek’s technology, which could rival the likes of OpenAI’s most sophisticated models, triggered a $1 trillion selloff in the stock market. Investors began to wonder if they had overpaid for companies like OpenAI and Meta for years.

This sudden disruption highlighted the possibility that the demand for AI might not be as large as the industry has projected, further fueling concerns about an oversupply of resources in the sector.

The Unstoppable AI Infrastructure Projects

Despite these concerns, investment in AI continues to skyrocket. The most Alibaba notable example is the ambitious $500 billion “Stargate” project, announced by President Donald Trump. This massive initiative is backed by major players like OpenAI, Oracle, SoftBank, and the state-run AI fund of Abu Dhabi. The first data center in the project, located in Abilene, Texas, is expected to house up to 400,000 Nvidia AI chips, making it one of the largest clusters of AI computing power ever.

Yet, Tsai remains skeptical about whether these huge investments are truly necessary. “I start to get worried when people are building data centers on spec,” he said, emphasizing that the demand may not be able to keep up with the rapid expansion of supply.

The Big Tech Spending Spree

The fear of a potential AI bubble is not just confined to China. Major U.S. tech companies are also committing enormous sums of money to AI. Amazon has pledged $100 billion for AI infrastructure, Meta CEO Mark Zuckerberg has committed $65 billion this year alone, and Google’s parent company, Alphabet, has set aside $75 billion for AI development.

Tsai is astounded by the staggering amounts of money being discussed in the U.S. around AI. “People are literally talking about $500 billion, several 100 billion dollars,” he said. “I don’t think that’s entirely necessary.” In his view, this kind of investment is ahead of the current demand and is based on projections of much higher demand in the Alibaba future, which may or may not materialize.

Conclusion: Is the AI Boom Too Good to Last?

The rapid pace of investment in AI infrastructure is both impressive and concerning. While there’s no denying the potential of AI to transform industries, the question remains whether the current level of spending is sustainable. With executives like Joe Tsai warning about the possibility of a bubble, the future of AI investment is uncertain. Will demand continue to rise as expected, or will the market find itself oversaturated with AI technology that no one really needs? Only time will tell. But for now, the debate over whether AI’s growth is sustainable or heading toward a financial crash is only just beginning.